Pre-Approved Pre-Paid

The Truth in Lending Act of 1968 effectively prohibits credit card issuers from sending you a real credit card that you did not apply for. While court cases and general regulatory pressure have greatly lessened the various scammy tactics some issuers took to get around these restrictions. It appears, however, that prepaid issuers are getting into the space.

When I was a product manager at Green Dot (NYSE:GDOT), I acquired a lot of prepaid cards. Dozens. I had a book of them. Part of my job was to understand all of our competition: the product offering, the terms, the packaging and the experience. This is why I am on NetSpend’s list somewhere.

I assume it’s from this that last week I received a totally unsolicited prepaid card in the mail from NetSpend. It seems a bit expensive to me, but maybe since they were acquired by TSYS last year they’ve expanded the marketing budget. Looking carefully at the materials, I understood that this was not an active card and that I would still need to pass identify verification/OFAC/KYC to get my card.

Sketchy tactics.

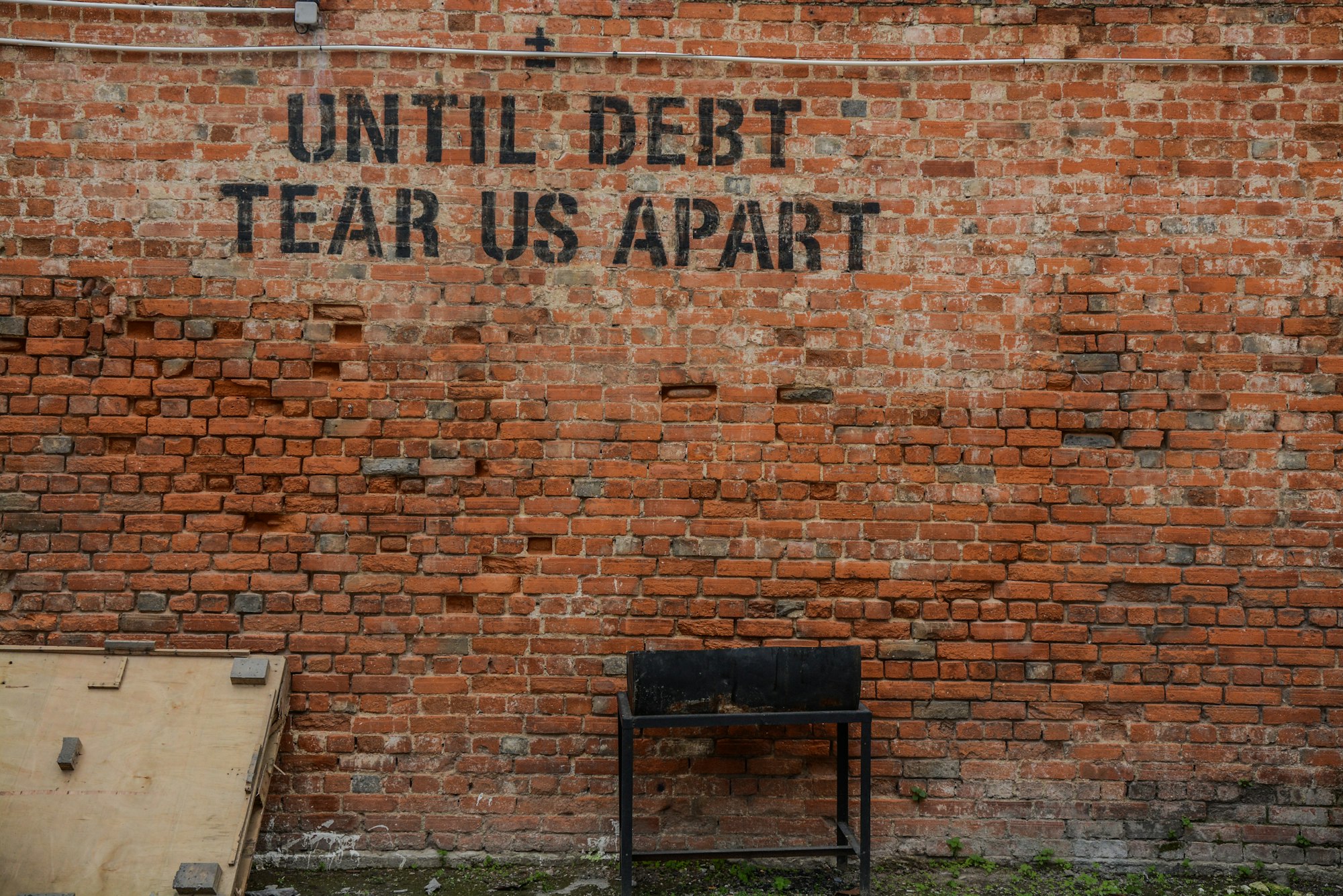

Prepaid card customers are already among the least well-educated consumers from a financial standpoint. Sending them a prepaid card with high fees (as all NetSpend cards are) to entice them to acquire the product is poor form. The big players in the National Branded Prepaid Card Association (including NetSpend) have long been making the argument in Washington that they can effectively self-regulate. While I doubt anyone can avoid the increasingly long arm of the Consumer Financial Protection Bureau, adopting this tactic, which looks, feels and smells like those banned in the Truth in Lending Act (even if it’s not lending) is not going to help their case.

I hope NetSpend’s test efforts fail and they move on. This is bad for consumers, bad for them and bad for everyone in the industry.